How to Register a Company in Pakistan – A Complete Guide (2025 Update)

Registering a company in Pakistan is a foundational step for any aspiring entrepreneur looking to establish a legitimate and credible business entity. While the process is designed to be straightforward, a thorough understanding of the steps involved, the necessary documentation, and compliance requirements is essential for a smooth incorporation. The Securities and Exchange Commission of Pakistan (SECP) stands as the primary regulatory authority overseeing this entire process.

This comprehensive guide provides an updated, step-by-step walkthrough for registering a private limited company in Pakistan, incorporating the latest procedures and vital information for 2025.

Understanding the Benefits of Company Registration

Before delving into the “how-to,” it’s important to grasp why company registration is beneficial:

- Legal Identity and Separate Entity Status: A registered company is a separate legal entity from its owners, offering limited liability protection. This means personal assets of shareholders are generally protected from business debts and liabilities.

- Enhanced Credibility and Trust: A formal company structure lends credibility to your business, making it easier to attract investors, secure bank loans, and engage with larger clients or government bodies.

- Perpetual Succession: Unlike sole proprietorships, a company has perpetual succession, meaning its existence is not affected by the death, insolvency, or resignation of its members.

- Easier Access to Finance: Banks and financial institutions often prefer lending to registered companies due to their structured legal framework and transparency.

- Transferability of Shares: Ownership in a company is easily transferable through the sale of shares, simplifying succession planning or bringing in new partners.

- Brand Protection: Registering your company name and, subsequently, trademarks offers legal protection for your brand identity.

Step 1: Name Reservation – Securing Your Company’s Identity

The journey begins with reserving a unique name for your company. This ensures that your chosen name is available and distinctive, avoiding conflicts with existing registered entities.

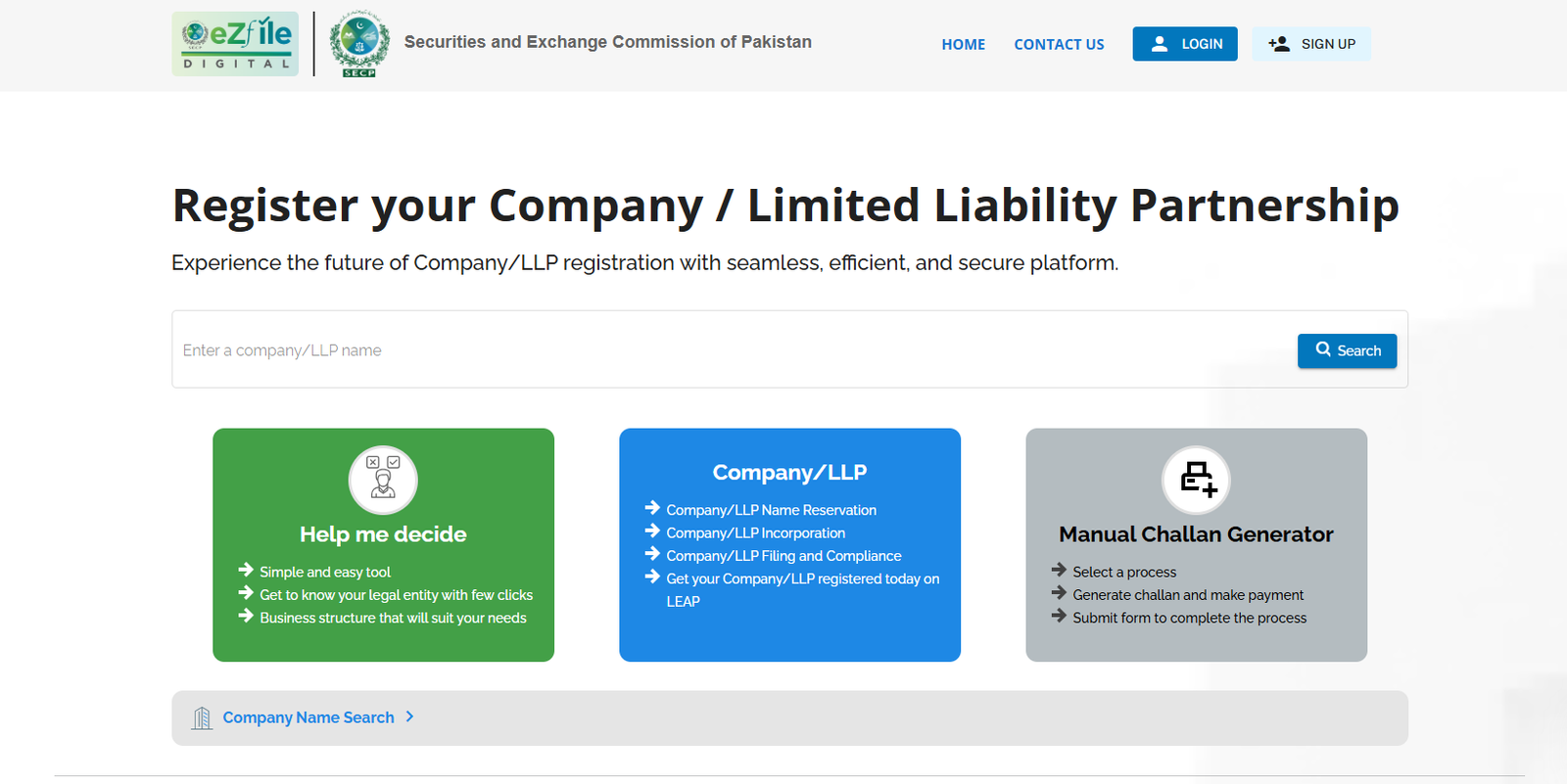

- Visit the SECP eServices Portal: The entire name reservation process is conducted online. Navigate to the official SECP eServices website.

- Create an Account and Log In: If you don’t already have one, create a user account. This account will be your primary interface with SECP throughout the incorporation and subsequent compliance processes.

- Submit an Application for Company Name Availability: Within the eServices portal, locate the option for “Company Name Availability” or “Name Reservation.” You will typically be asked to propose up to three names in order of preference.

- Conduct a Thorough Name Search: Before submitting your application, utilize the company name search tool available on the SECP’s website. This preliminary search can save you time by indicating if your desired name, or a confusingly similar one, is already registered. Consider variations, common misspellings, and industry-specific terms.

- Criteria for Name Approval: SECP evaluates names based on several criteria, including uniqueness, absence of offensive or misleading terms, and compliance with general naming conventions. Names that are too general, identical to existing companies, or contain prohibited words will be rejected.

Processing Time: Typically 1–2 working days.

Fee: PKR 200 (Please note that all fees are subject to SECP’s latest fee schedule and can be verified on their official website or through the eServices portal).

Step 2: Prepare Required Documents – The Blueprint of Your Company

Once your company name is approved, the next critical phase involves preparing the foundational legal documents that define your company’s existence, purpose, and internal governance. Accuracy and attention to detail here are paramount.

-

Memorandum of Association (MOA):

- This is the most crucial document, outlining the fundamental framework of your company. It defines the company’s objects (what business activities it intends to undertake), its liability (usually limited by shares), its authorized share capital, and the names of its first subscribers (founding members) and the shares they intend to subscribe for.

- Preparation: Draft four original signed copies. Ensure the objects clause is comprehensive enough to cover all intended current and future business activities without being overly broad or vague. It’s advisable to include a general clause allowing the company to engage in any lawful business ancillary to its main objectives.

-

Articles of Association (AOA):

- The AOA acts as the company’s internal rulebook, governing its day-to-day operations and the relationship between the company, its directors, and its shareholders. It covers aspects such as the appointment and powers of directors, conduct of board and general meetings, voting rights, transfer of shares, declaration of dividends, and auditing procedures.

- Preparation: Prepare four original signed copies. While model Articles are often available, it’s crucial to tailor them to your specific company’s needs, especially regarding shareholder agreements, special rights, or director powers.

-

Form 1 (Declaration of Compliance):

- This is a statutory declaration confirming that all legal requirements for the registration of the company have been duly complied with. It must be filed by a director, secretary, or an authorized professional (like a lawyer or consultant) involved in the incorporation process.

- Preparation: Complete and sign one original copy.

-

Form 21 (Notice of Company’s Registered Office):

- This form officially notifies SECP of the physical address that will serve as the company’s registered office. This is where all official communication from SECP and other regulatory bodies will be directed.

- Preparation: Complete and sign one original copy. The address must be a physical location in Pakistan.

-

Form 29 (Particulars of Directors, CEO, etc.):

- This form provides detailed particulars of all individuals who will serve as directors, the chief executive officer (CEO), and the company secretary of the newly incorporated company. It includes their names, addresses, CNIC/passport numbers, and consent to act.

- Preparation: Prepare two original signed copies. Ensure all details are accurate and match their official identification documents.

-

Power of Attorney (if applicable):

- If you are engaging a consultant, lawyer, or any other authorized person to handle the submission of documents and coordinate with SECP on your behalf, a Power of Attorney (POA) is mandatory. This document legally empowers them to act for the company’s subscribers.

- Preparation: Draft and execute the POA as per legal requirements, clearly outlining the scope of authority granted.

-

Copies of CNICs/Passports:

- Attach clear and legible scanned copies of the Computerized National Identity Cards (CNICs) for all Pakistani nationals involved. For foreign nationals, scanned copies of their passports are required.

- Required for: All directors, initial subscribers/witnesses signing the MOA & AOA, and the authorized person (if different from a director/subscriber). Ensure the copies are clear and verifiable.

Step 3: Submit Application to SECP – The Online Filing

With all documents prepared and finalized, the next step is the actual submission of your incorporation application through the SECP eServices portal.

- Log in to the SECP eServices Portal: Access your created user account.

- Complete the Company Incorporation Application: Select the option for “Company Incorporation” or “New Incorporation” within the portal. The system will guide you through an online form where you’ll input key company details, director information, and share capital structure.

- Upload Required Documents: Crucially, you will be prompted to upload the scanned copies of all the documents prepared in Step 2 (MOA, AOA, Forms 1, 21, 29, POA, and CNIC/Passport copies). Ensure that all uploaded documents are in the correct format (usually PDF) and are clearly legible.

- Pay the Registration Fee: The final step in the online submission is the payment of the prescribed registration fee. The system will calculate the fee based on your company’s authorized capital. This payment is typically made via online banking (IBFT), credit/debit card, or through designated banks.

Mode of Submission: Exclusively online via SECP eServices. Physical submissions are largely phased out for company incorporation.

Fee: Varies based on the company’s authorized capital. For instance, for a company with a nominal authorized capital (e.g., up to PKR 100,000), the fee might be approximately PKR 1,500. Fees incrementally increase for larger authorized capital amounts. Always refer to the SECP’s official fee schedule for the most current rates.

Step 4: Receive Certificate of Incorporation – Your Legal Recognition

After your application and documents are submitted, SECP’s review team will scrutinize them for compliance with the Companies Act, 2017, and relevant regulations. If everything is in order, your Certificate of Incorporation will be issued.

- Verification Process: SECP verifies the submitted information and documents. They may raise observations or requisitions if any discrepancies or additional information are required. Promptly addressing these requisitions is key to avoiding delays.

- Issuance of Certificate: Upon successful verification, SECP will digitally issue the Certificate of Incorporation. This certificate is the definitive legal proof that your company is now officially registered and recognized as a legal entity under Pakistani law.

- Delivery: The Certificate of Incorporation, along with stamped copies of the MOA and AOA, will be delivered electronically to your registered email address associated with your eServices account. You can also download it from your eServices dashboard.

Important Tips for a Smooth Registration

- Choose a Unique and Brandable Name: Select a name that is not only unique but also easy to remember, pronounce, and align with your brand identity. Conduct thorough searches to avoid potential trademark issues later.

- Clearly Define Business Activities in MOA: Be meticulous in drafting your company’s objects clause in the MOA. Broad enough to cover future ventures, but specific enough to avoid ambiguity.

- Accuracy in Details: Double-check all information provided in the forms and documents. Even minor discrepancies in names, CNIC numbers, or addresses can lead to rejections and delays.

- Secure SECP Login Credentials: Your SECP eServices account is crucial. Keep your username and password secure, as it will be used for all future compliance filings.

- Seek Professional Assistance: While the process is outlined, navigating legal terminology, drafting complex documents like MOA/AOA, and understanding SECP’s nuances can be challenging. Engaging a qualified legal consultant, corporate secretarial service, or chartered accountant specializing in corporate matters can significantly expedite the process and prevent errors.

After Incorporation – What’s Next?

Company incorporation is just the beginning. Several critical post-incorporation compliances are necessary to ensure your business operates legally and smoothly:

- Register for NTN (National Tax Number) with FBR: Every registered company must obtain an NTN from the Federal Board of Revenue (FBR) to fulfill its tax obligations, including filing income tax returns and sales tax (if applicable).

- Open a Corporate Bank Account: A dedicated corporate bank account is essential for managing your company’s finances, separating personal and business funds, and maintaining financial records.

- Get Registered with PSEB (Pakistan Software Export Board): If your company operates in the IT or IT-enabled services sector and intends to engage in exports, registration with PSEB can offer various benefits and incentives.

- Maintain Company Compliance: This is an ongoing responsibility. It includes:

- Annual Returns: Filing annual returns with SECP (e.g., Form A/Form B/Form C) within prescribed deadlines.

- Board Meetings and General Meetings: Holding regular board meetings and annual general meetings (AGMs) as per the Companies Act.

- Statutory Registers: Maintaining various statutory registers (e.g., register of members, directors, charges) at the company’s registered office.

- Financial Statements: Preparing and auditing financial statements annually.

- Tax Filings: Regular filing of income tax, sales tax, and other applicable tax returns with FBR.

Final Thoughts

Company registration in Pakistan has become significantly more efficient with the digitalization of processes by the SECP. With proper preparation and understanding, the entire incorporation process can typically be completed within 5 to 7 working days. Whether you are launching an innovative startup, establishing a freelancing agency, or planning to attract significant investment, incorporating a private limited company provides your business with a robust legal identity, enhanced credibility, and the framework for sustainable growth in the Pakistani market.

If you find the documentation, SECP filing procedures, or ongoing post-registration compliance daunting, do not hesitate to contact our experts. Professional guidance can simplify the journey and ensure your business starts on the right legal footing.