✅ How to Check Your Filer Status in Pakistan (Updated 2025 Guide)

If you live or do business in Pakistan, staying updated on your filer status with the FBR (Federal Board of Revenue) is essential. Being an active taxpayer (filer) not only keeps you compliant with the law but also unlocks financial perks like lower taxes and faster refunds.

This step-by-step guide will walk you through all the easy ways to check your filer status — online, by SMS, through mobile apps, or by downloading the official ATL list.

🔍 4 Ways to Check Your Filer Status with FBR

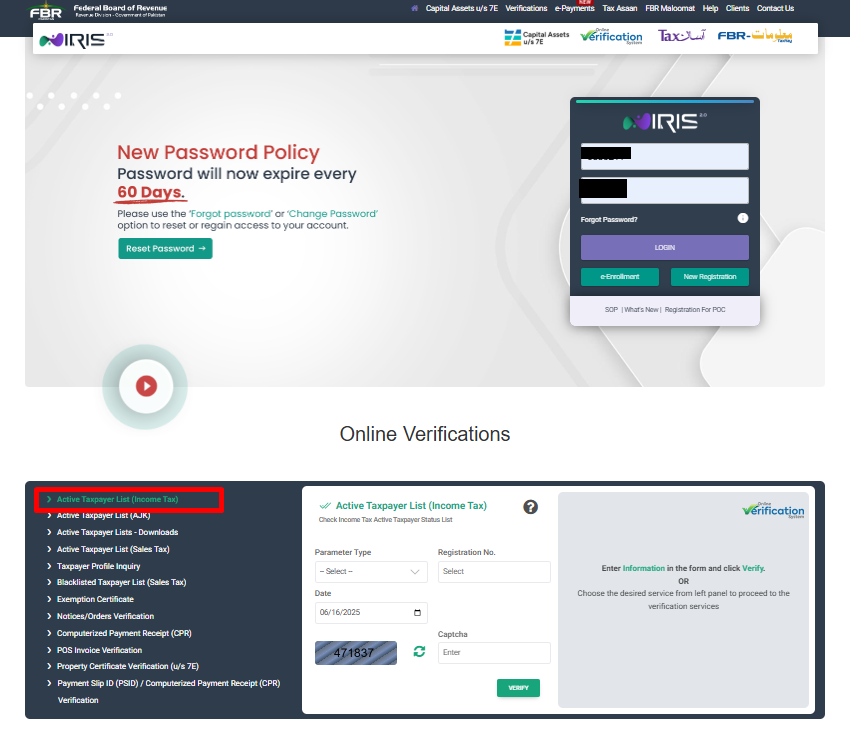

✅ 1. Check Online via FBR IRIS Portal

Steps:

-

Visit the official FBR verification page: https://iris.fbr.gov.pk/#verifications

-

Scroll down to “Online Verification Services.”

-

Select “ATL (Active Taxpayer List)” from the list.

-

Enter your CNIC, NTN, or Passport number.

-

Choose the appropriate parameter (CNIC, NTN, or Passport).

-

Enter today’s date and the Captcha.

-

Click “Verify”.

The system will show whether you’re a filer or non-filer.

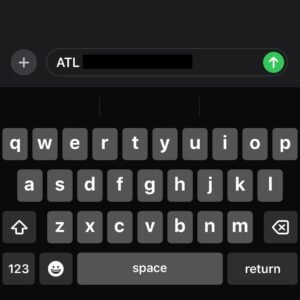

✅ 2. Check via SMS (No Internet Needed)

Quick & Easy:

-

Send an SMS to 9966

-

Format:

ATL<space>CNIC number(without dashes) -

Example:

ATL 3520112345678

You’ll get an instant reply with your tax status.

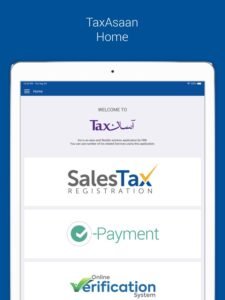

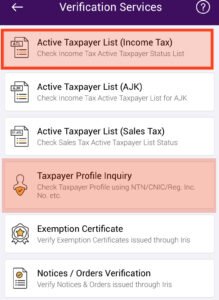

✅ 3. Use the FBR Tax Asaan Mobile App

Steps:

-

Download “Tax Asaan” from Google Play or Apple App Store.

-

Open the app and go to Active Taxpayer List.

-

Enter your CNIC, NTN, or Passport number.

-

View your filer status on-screen.

The app also allows you to file returns, view tax history, and generate payment challans.

✅ 4. Download the Active Taxpayer List (ATL)

-

Go to FBR’s website and download the ATL in Excel format.

-

The list is updated after every 24-48 Hours.

🎯 Why You Should Be a Filer in Pakistan

Being listed as an Active Taxpayer gives you significant financial benefits:

| Benefit | Description |

|---|---|

| 💸 Lower Tax Rates | On property transactions, banking, vehicles, etc. |

| 💼 Business Credibility | Required for tenders, licenses, and contracts |

| 🔄 Tax Refunds | Claim eligible refunds faster |

| ⛔ Avoid Extra Charges | Non-filers pay up to 100% more in withholding tax |

If you check your status and find that you’re not on the ATL, it usually means:

-

You haven’t filed your tax return, or

-

You didn’t pay the annual ATL surcharge.

Surcharge Fees to be Included:

-

🏢 Companies: PKR 20,000

-

🏘️ AOPs (Partnerships): PKR 10,000

-

👤 Individuals: PKR 1,000

After paying the surcharge and/or filing your return, your name is added to the ATL.

📞 Need Help Filing or Getting on the ATL?

ABH Tax Consultants (Islamabad) can help you:

-

File your tax return correctly

-

Pay your ATL surcharge

-

Maintain your active filer status

-

Avoid higher taxes and penalties

🔚 Final Thoughts

Staying active on the FBR’s ATL is more than just compliance — it’s smart money management. Whether you’re a freelancer, salaried person, or business owner, knowing your tax status and taking action can save you thousands annually.

Stay informed. Stay compliant. Stay ahead.

Need help? Sterling.pk are just a call away.