Contact Info

- Office no 2, First floor , Plaza 21, First lane , Square commercial, Phase 7 Bahria Town, Islamabad

- info@sterling.pk

- 0319 7508007

Blogs

- 5 Reasons to Track Your Expenses

- Salary Tax Slabs 2024-25 Pakistan

- Form 29 SECP

Services

- SECP Company Registration

- PSEB Company Registration

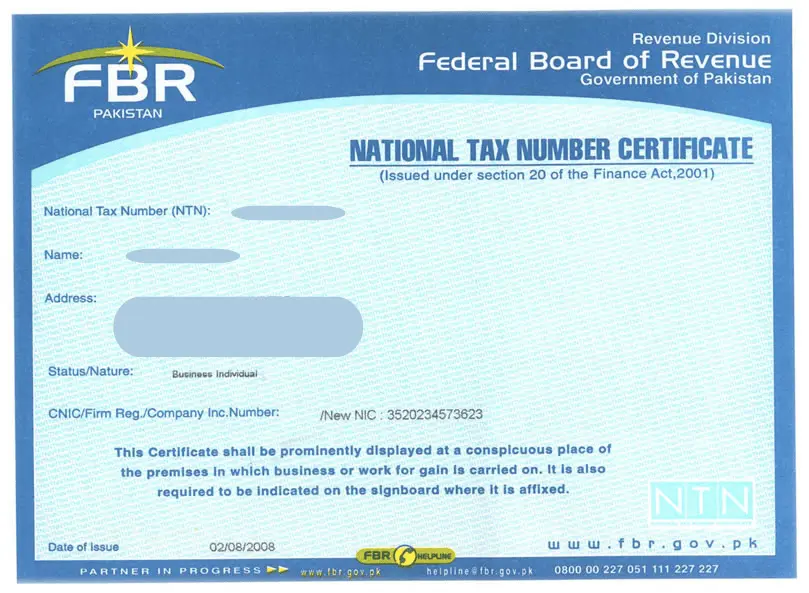

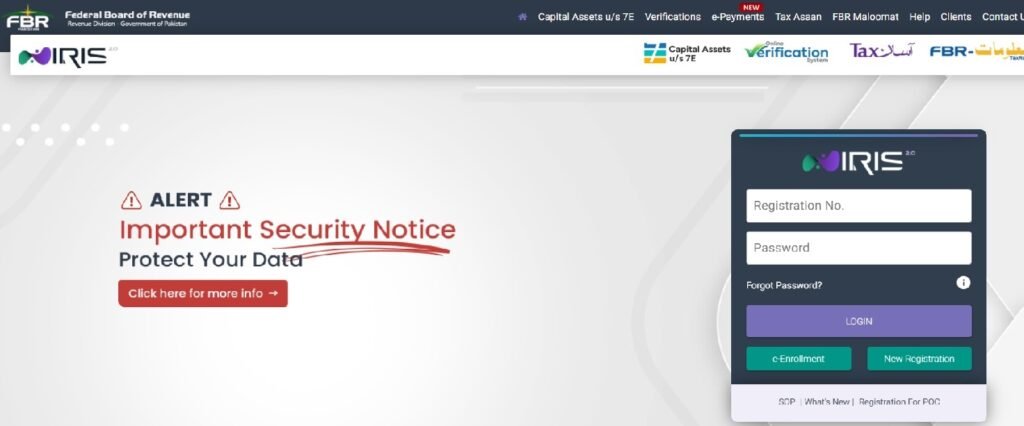

- NTN Registration