In Pakistan, verifying the registration status of a business is an essential step for entrepreneurs, clients, suppliers, and regulatory bodies. Whether you’re a company founder wanting to confirm your business incorporation or an individual checking the legitimacy of a third-party company, several official platforms are available for business status verification. The process varies depending on the business structure and the registration authority involved, such as the Securities and Exchange Commission of Pakistan (SECP), Federal Board of Revenue (FBR), Registrar of Firms, or provincial authorities.

This guide provides a complete overview of how to check the registration status of various types of businesses in Pakistan using official government portals and other tools.

Understanding Business Registration Types in Pakistan

Before exploring the methods for status verification, it is important to know the different types of business entities in Pakistan, each governed by different laws and authorities:

-

Sole Proprietorship

-

Partnership Firm

-

Private Limited Company

-

Single Member Company (SMC)

-

Public Limited Company

-

Limited Liability Partnership (LLP)

-

Foreign Company Branch or Liaison Office

-

Non-Profit Organization (NPO)/NGO

Each structure follows a specific registration route and is recorded by a relevant authority. Therefore, the platform used to check registration status will depend on the entity type.

Why You May Need to Check Business Registration Status

Checking the business registration status is useful in the following scenarios:

-

Verifying your own company’s incorporation status

-

Conducting due diligence before entering into a contract

-

Confirming tax registration with FBR

-

Ensuring the legitimacy of a business partner or vendor

-

Applying for bank loans or tenders

-

Monitoring the renewal or compliance status of your business

SECP Registered Companies – Online Verification

The Securities and Exchange Commission of Pakistan (SECP) is the primary authority for registration of:

-

Private Limited Companies

-

Single Member Companies (SMCs)

-

Public Limited Companies

-

LLPs

-

Foreign Company Branches

To check the registration status of these companies:

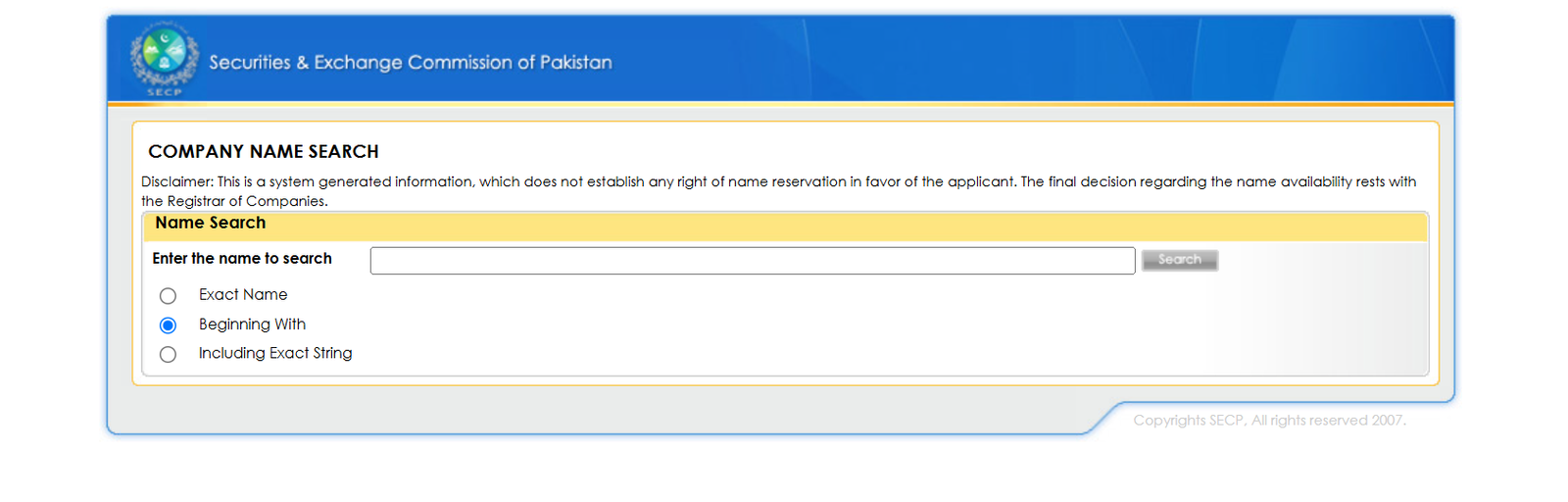

Step-by-Step Guide Using SECP Website

-

Visit the official SECP e-portal website: https://secp.gov.pk/

-

Navigate to the “Company Name Search” section

-

Enter the exact name of the company or use partial name for broader results

-

Click on the Search button

-

The system will show:

-

Company Name

-

Incorporation Number

-

Incorporation Date

-

Company Status (Active/Inactive)

-

Type (SMC, Pvt Ltd, etc.)

-

Registered Office

-

This feature is commonly used for verifying if a company is active or dormant.

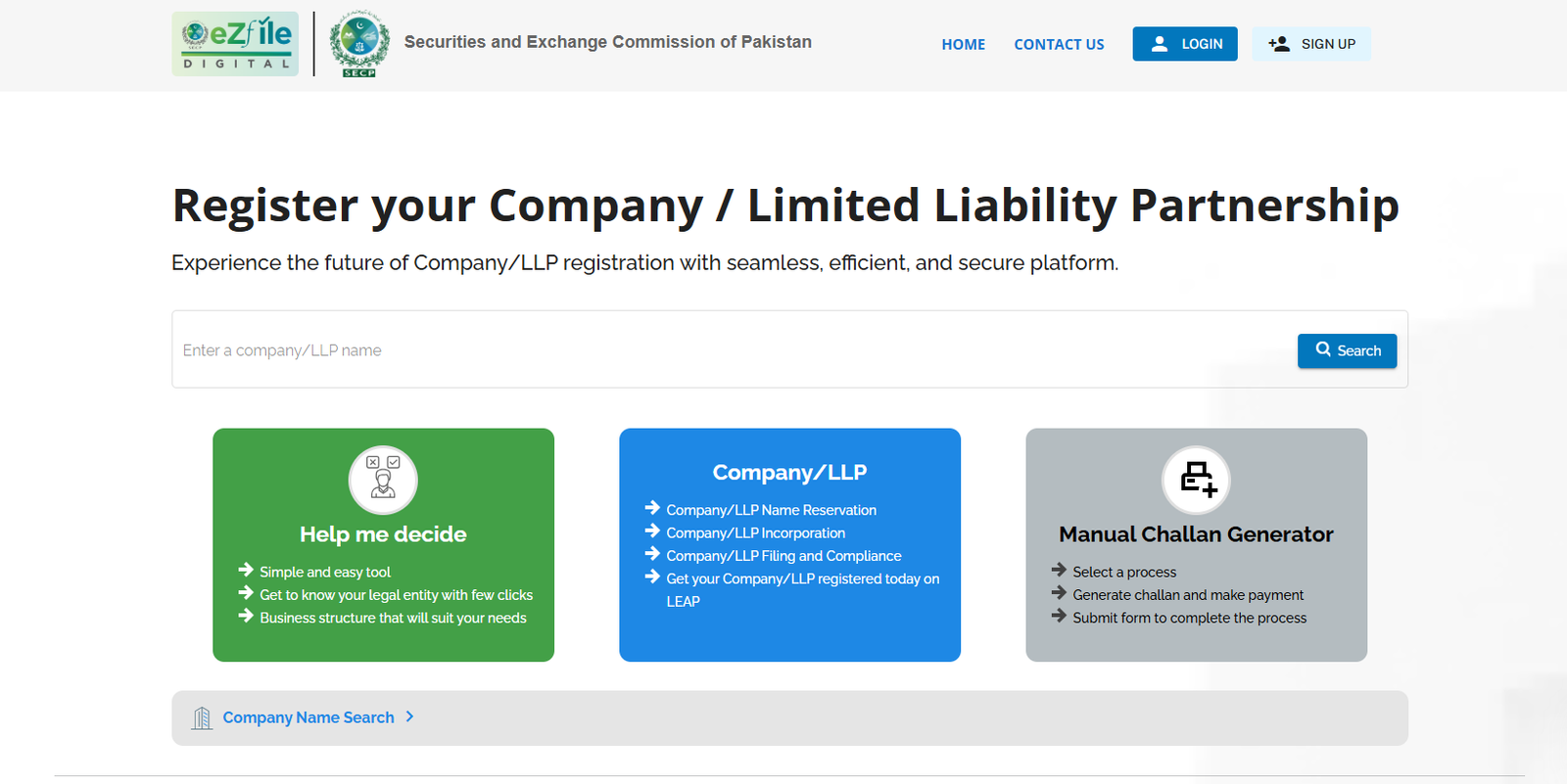

Alternative: SECP eServices Portal

If you are the business owner or authorized representative:

-

Log into the SECP eServices Portal

-

Go to your registered dashboard

-

View company details, filings, status of pending documents, and compliance status

This method gives more detailed internal insights including:

-

Compliance with statutory filings

-

Pending Form A or Form 29

-

Renewal notifications

-

Payment status for renewal fees

FBR NTN and Taxpayer Verification

Every business in Pakistan, regardless of its structure, must register with the Federal Board of Revenue (FBR) and obtain a National Tax Number (NTN). This applies to:

-

Sole Proprietors

-

Partnership Firms

-

Companies

To verify the FBR registration status:

FBR Online Verification Process

-

Select your desired category:

-

Individual NTN

-

Company NTN

-

Sales Tax Registration

-

-

Enter the CNIC or NTN number

-

The system will display:

-

Registered Business Name

-

NTN

-

Registration Date

-

Business Activity

-

Business Address

-

This is one of the most reliable ways to verify that a business is tax-registered and compliant.

Partnership Firms – Registrar of Firms

Partnerships are registered with the Registrar of Firms in the relevant district under the Partnership Act, 1932. Unfortunately, this verification is not fully digitized in many provinces. However, you can verify registration through:

In-Person Verification

-

Visit the District Registrar of Firms Office where the partnership is registered

-

Provide the name of the firm and date of registration

-

Request a copy or verification letter from the register

Punjab e-Governance Option

In Punjab, some registration data is available via the Punjab Business Portal:

-

Use the “Search Business” function if available

-

Enter firm name or application reference

This portal is limited to businesses registered in Punjab only.

Sole Proprietorship Verification

Sole proprietorships are not formally registered with SECP or any central body but must register with:

-

FBR for NTN

-

Local Chamber of Commerce (optional)

-

Trade License Authorities (for specific professions or sectors)

How to Check Sole Proprietorship Status

-

Use the FBR Taxpayer Portal for NTN confirmation

-

Request verification from Chamber of Commerce if the business is a member

-

Ask for the copy of Sales Tax Certificate or Trade License if applicable

Since there is no central database, verification depends on cross-checking with FBR and local licensing bodies.

PSEB Registered IT Companies

The Pakistan Software Export Board (PSEB) certifies IT and software companies for various benefits including tax incentives. To check status:

-

Search by company name or NTN

-

View details like:

-

Registration Number

-

Validity Period

-

Sector (IT, BPO, etc.)

-

Location

-

This is important when verifying export-oriented IT businesses.

PEC Verification for Construction Companies

Construction, architecture, and engineering companies need registration with Pakistan Engineering Council (PEC). To check their status:

-

Visit https://www.pec.org.pk

-

Go to the “Registered Firms” section

-

Enter company name or license number

-

View:

-

Category

-

Validity

-

Discipline

-

Owner Name

-

Only PEC-certified companies are eligible for public sector projects.

NGO/NPO Status Verification

NGOs and NPOs must register with multiple bodies including:

-

SECP (under Section 42)

-

FBR (for tax exemptions)

-

Economic Affairs Division (for foreign donations)

To check their registration:

-

Use SECP’s Company Name Search for confirmation

-

Check FBR Exempt Entities List published annually

-

Verify licensing with Economic Affairs Division if foreign funded

Tips for Accurate Status Verification

-

Always use official government websites

-

Make sure the spelling of the company is correct

-

Cross-check multiple sources (SECP + FBR)

-

Ask for incorporation certificate, NTN certificate, and tax returns if needed

-

Avoid third-party sites or unverifiable portals

Common Issues While Verifying

-

SECP name search showing similar names – always check incorporation number

-

NTN showing no results – may be inactive or incorrectly entered

-

Local registrar offices lacking digital records

-

Proprietorships hard to verify if not registered with Chamber

What to Do if a Business is Not Found

If your business or the business you are checking does not appear in public search results:

-

Confirm that you’re using the correct name/NTN

-

Contact SECP via phone or email for clarification

-

Contact FBR regional office

-

Visit Registrar of Firms physically if it’s a partnership firm

-

Inquire with professional services firm like Sterling.pk for expert support

Role of Sterling.pk in Verification Support

At Sterling.pk, we help clients:

-

Verify legal registration of potential partners and suppliers

-

Conduct due diligence before investment or joint venture

-

Confirm compliance of existing companies

-

File RTI or legal request to access corporate records

-

Prepare documentation if a company’s registration is not updated

With our in-depth experience in corporate law and access to the right channels, we make verification processes easy and hassle-free for you.

Conclusion

Checking the status of a business registration in Pakistan is a crucial step for maintaining transparency and conducting lawful transactions. Thanks to digital advancements, entities registered with SECP, FBR, PEC, and PSEB can be verified online in a matter of minutes. However, for partnerships and sole proprietorships, physical verification may still be necessary.

Using the right tools and procedures outlined in this guide can help you confirm whether a business is properly registered and compliant. Whether you’re starting your own company or working with others, verifying registration protects you from fraud, ensures regulatory compliance, and builds business credibility.

For expert assistance in verifying any type of business in Pakistan, contact Sterling.pk—your trusted partner for corporate compliance.